The Kam Financial & Realty, Inc. PDFs

The Kam Financial & Realty, Inc. PDFs

Blog Article

6 Simple Techniques For Kam Financial & Realty, Inc.

Table of ContentsUnknown Facts About Kam Financial & Realty, Inc.The Greatest Guide To Kam Financial & Realty, Inc.What Does Kam Financial & Realty, Inc. Mean?Some Known Details About Kam Financial & Realty, Inc. The 7-Minute Rule for Kam Financial & Realty, Inc.The Only Guide for Kam Financial & Realty, Inc.Kam Financial & Realty, Inc. Fundamentals Explained

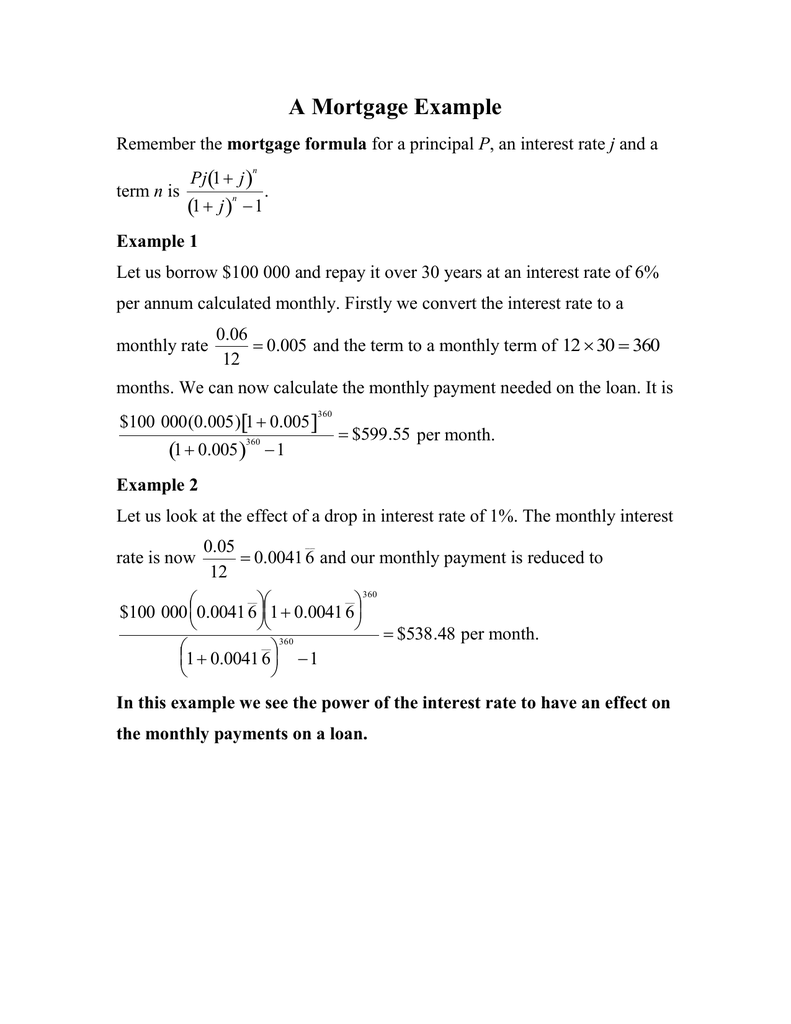

Buying a home is a significant turning point in lots of people's lives. Nevertheless, that doesn't suggest the process is clear to those individuals. The home getting procedure includes several steps and variables, indicating each person's experience will certainly be distinct to their family members, economic circumstance, and preferred residential or commercial property. Yet that does not imply we can not aid make feeling of the home mortgage process.A is a type of lending you utilize to acquire building, such as a home. Usually, a lender will give you a collection quantity of cash based on the value of the home you desire to buy or possess.

7 Easy Facts About Kam Financial & Realty, Inc. Shown

To get approved for a home mortgage car loan, you will require to be at the very least 18 years old. Aspects that aid in the home loan procedure are a trustworthy earnings resource, a strong credit report, and a modest debt-to-income proportion. (https://sandbox.zenodo.org/records/137781). You'll discover more about these consider Component 2: A is when the homeowner gets a brand-new home loan to replace the one they currently have in place

A features likewise to a first home mortgage. An operates a little bit differently from a standard mortgage car loan and is comparable to a credit score card.

This co-signer will certainly consent to make settlements on the home mortgage if the consumer does not pay as concurred. Title business play an essential function making sure the smooth transfer of home possession. They research state and county records to validate the "title", or possession of your house being bought, is free and free from any various other home mortgages or commitments.

Some Ideas on Kam Financial & Realty, Inc. You Need To Know

Additionally, they provide written guarantee to the lending establishment and develop all the documents needed for the mortgage. A deposit is the quantity of cash money you need to pay upfront in the direction of the acquisition of your home. If you are buying a home for $100,000 the lender may ask you for a down settlement of 5%, which implies you would be called for to have $5,000 in cash as the down settlement to get the home. (https://hearthis.at/kamfnnclr1ty/set/kam-financial-realty-inc./).

The majority of loan providers have conventional home loan guidelines that permit you to obtain a particular percent of the value of the home. The portion of principal you can obtain will vary based on the home loan program you certify for.

There are special programs for novice home buyers, professionals, and low-income consumers that permit lower down settlements and greater percents of principal. A home mortgage lender can review these alternatives with you to see if you qualify at the time of application. Passion is what the lender costs you to obtain the money to buy the home.

Some Of Kam Financial & Realty, Inc.

If you were to take out a 30-year (360 months) mortgage and obtain that same $95,000 from the above example, the overall amount of rate of interest you would certainly pay, if you made all 360 monthly settlements, would be a little over $32,000. Your monthly settlement for this finance would certainly be $632.

Most loan providers will certainly need you to pay your tax obligations with your mortgage repayment. Building tax obligations on a $100,000 loan could be around $1,000 a year.

9 Easy Facts About Kam Financial & Realty, Inc. Described

:max_bytes(150000):strip_icc()/standing-mortgage.asp_Final-f243f07e8a22431ba1a4c32616f127a2.jpg)

Once more, due to the fact that the home is seen as security by the lender, they desire to make sure it's shielded. Like taxes, the lending institution will additionally offeror often requireyou to include your insurance policy premium in your regular monthly settlement.

Your settlement now would certainly boost by $100 to a brand-new overall of $815.33$600 in concept, $32 in interest, $83.33 in tax obligations, and $100 in insurance policy. The loan provider holds this cash in the same escrow account as your real estate tax and pays to the insurance provider on your behalf. Closing costs refer to the costs connected with refining your financing.

The Single Strategy To Use For Kam Financial & Realty, Inc.

This ensures you recognize the complete price and consent to continue prior to the funding is moneyed. There are several programs and loan providers you can choose from when you're getting a home and obtaining a home mortgage who can assist you navigate what programs or options will certainly function best for you.

The Definitive Guide to Kam Financial & Realty, Inc.

Several financial organizations and actual estate representatives can assist you recognize exactly how much money you can invest in a home and what financing amount you will qualify for. Do some study, yet likewise request for recommendations from your friends and family members. Finding the best companions that are an excellent fit for you can make all the distinction.

Report this page